Understanding Medicare Part A: Coverage, Costs, and Eligibility Explained

- Home

- Understanding Medicare Part A: Coverage, Costs, and Eligibility Explained

What is Medicare Part A?

Medicare Part A is the core component of Original Medicare that provides inpatient hospital insurance, helping seniors manage the high costs of hospital stays and related medical services. While coverage and cost details can change slightly each year, Part A remains an essential benefit for millions of Americans entering retirement.

Most individuals become eligible for Medicare Part A at age 65, and many receive it premium-free if they or their spouse have paid Medicare taxes for the required number of working years. This makes Medicare Part A a foundational, cost-effective form of health protection.

In this guide, you’ll learn everything you need to know about Medicare Part A,

its coverage, costs, eligibility rules, and important enrollment deadlines, so you can make confident and informed healthcare decisions.

What Does Medicare Part A Cover?

Medicare Part A provides essential hospital insurance and is the foundation of Original Medicare. It focuses on inpatient and facility-based care, helping beneficiaries manage the costs of medically necessary treatment.

Medicare Part A covers the following services:

• Inpatient hospital care, including accommodation, nursing, and necessary medical services

• Inpatient mental health treatment in a psychiatric or general hospital

• Inpatient rehabilitation services after illness, surgery, or injury

• Hospice care for individuals with a terminal diagnosis

• Limited home health services when medically required

• Short-term stays in a skilled nursing facility after a qualifying hospital stay

Coverage details, time limits, and eligibility requirements vary depending on the type of care received. Medicare uses specific guidelines to determine how long each service is covered and what qualifies as medically necessary.

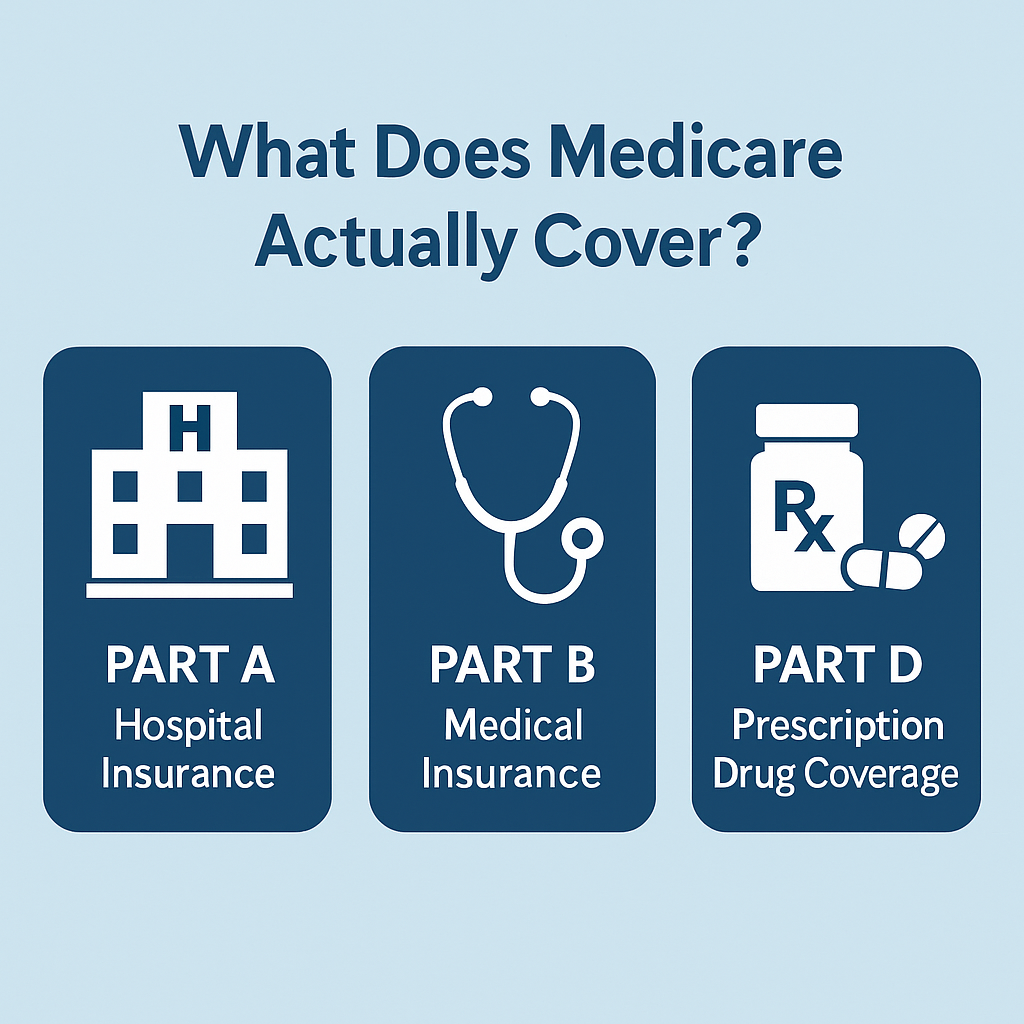

What Is the Difference Between Medicare Part A and Part B?

Medicare Part A and Part B work together but cover different types of medical services. Part A focuses on inpatient care, while Part B covers outpatient and medical services you receive outside a hospital stay.

Medicare Part B includes coverage for:

• Doctor visits and specialist consultations

• Emergency room and urgent care services

• Diagnostic tests, including lab work and X-rays

• Preventive care, such as screenings and vaccines

• Outpatient treatments and certain medical equipment

In simple terms, Part A handles hospital-based care, and Part B helps pay for the medical services you use before, during, or after those hospital visits. Here is the comparison between Medicare Part A and Medicare Part B.

| Feature / Coverage Area | Medicare Part A | Medicare Part B |

|---|---|---|

| Type of Coverage | Inpatient Hospital Insurance | Outpatient Medical Insurance |

| Primary Focus | Hospital stays, skilled nursing, hospice, limited home health | Doctor services, preventive care, diagnostics, outpatient treatments |

| Common Services Covered | Inpatient hospital care, inpatient rehab, SNF stays, hospice care | Doctor visits, ER and urgent care, lab tests, X-rays, outpatient care |

| Costs | Often premium-free for most people who paid Medicare taxes | Monthly premium required for most beneficiaries |

| When It Applies | During hospital or facility-based care | Before, during, or after inpatient care; routine medical visits |

| Enrollment | Automatic for most at age 65 | Requires active enrollment unless automatically enrolled |

Is Medicare Part A Free at Age 65? Costs, Premiums, Deductibles, and Coinsurance for 2026

Medicare Part A is premium-free for many people once they turn 65, but not everyone qualifies for free coverage. Costs can also change from year to year, and 2025 includes updates to deductibles and coinsurance amounts. Understanding these expenses helps you plan for your hospital and inpatient care needs.

Part A Premiums for 2026

Your monthly premium depends on how long you or your spouse worked and paid Medicare taxes.

| Work History (Total Quarters) | Monthly Premium in 2026 |

|---|---|

| 40 quarters or more (10+ years) | $0 |

| 30–39 quarters | $285 |

| Fewer than 30 quarters | $518 |

Even if your premium is $0, you are still responsible for other costs whenever you receive inpatient care.

Part A Deductible for 2026

The deductible is the amount you must pay before Medicare Part A begins covering your inpatient costs.

• 2026 Part A deductible: $1,676 per benefit period

A benefit period starts the day you are admitted as an inpatient and ends after 60 days without inpatient or skilled nursing care. Your status matters, so always confirm whether you’re classified as an inpatient or outpatient.

Part A Coinsurance for Inpatient Hospital Care (2026)

After paying your deductible, coinsurance amounts apply depending on how long you’ve been hospitalized.

| Length of Stay | Coinsurance Amount |

|---|---|

| Days 1–60 | $0 per day |

| Days 61–90 | $419 per day |

| Day 91+ (Lifetime Reserve Days) | $838 per day |

Medicare provides 60 lifetime reserve days total. Once all reserve days are used, you pay the full cost for additional inpatient days.

Skilled Nursing Facility Coinsurance (2026)

If your care continues in a skilled nursing facility after a qualifying hospital stay:

| Length of Stay | Coinsurance Amount |

|---|---|

| Days 0–20 | $0 |

| Days 21–100 | $209.50 per day |

| Day 100+ | All costs |

Additional Coverage Options for Hospital-Related Costs

• Medicare Advantage (Part C):

Medicare Advantage Part C Private plans that include all benefits of Parts A and B, with many offering prescription drug coverage and additional services like dental or vision.

• Medicare Supplement (Medigap):

Private insurance plans that help pay out-of-pocket costs not covered by Parts A and B, including deductibles and coinsurance. Coverage varies by plan and state.

Who Is Eligible for Medicare Part A?

Most people become eligible for Medicare Part A when they turn 65. To receive Part A with no monthly premium, you must meet at least one of the following requirements:

• You worked and paid Medicare taxes for 40 quarters (about 10 years).

• Your spouse has enough work credits, even if you do not.

• You currently receive Social Security or Railroad Retirement Board benefits.

• You or your spouse were government employees covered under Medicare.

Certain individuals can enroll in Medicare earlier due to specific health conditions. You may qualify for Medicare Part A before age 65 if you have:

• A qualifying disability

• Amyotrophic lateral sclerosis (ALS)

• End-stage renal disease requiring dialysis or a transplant

Many people who meet these conditions are automatically enrolled in Medicare Part A. If you do not qualify for automatic enrollment, you must apply manually to activate your Part A coverage.

When Are the Medicare Part A Enrollment Deadlines?

Your enrollment window for Medicare Part A is based on your 65th birthday. Most people have a 7-month Initial Enrollment Period, which includes:

• Three months before the month you turn 65

• Your birth month

• Three months after your 65th birthday

Enrolling during this period ensures your benefits start on time and helps you avoid late-enrollment penalties.

If you miss your Initial Enrollment Period, you can still enroll in Medicare during the General Enrollment Period, which runs from January 1 to March 31 each year. However, late enrollment may result in higher premiums and a delay in when your Medicare coverage begins.

Key Points to Understand About Medicare Part A

Medicare Part A provides critical coverage for hospital stays, skilled nursing care, and other inpatient services, helping reduce out-of-pocket healthcare expenses for seniors. For many, Part A is a valuable benefit earned through years of paying Medicare taxes while working.

While some individuals are automatically enrolled in Medicare Parts A and B by the Social Security Administration, not everyone is enrolled automatically. If you or a loved one is approaching age 65, it is important to review your options and enroll in Medicare during the appropriate enrollment period.

Keep in mind that Medicare plan options, coverage rules, and costs can change annually, so staying informed each year ensures you maintain the coverage that best meets your healthcare needs